Funding Position - Remortgage Loan

This section covers information about Funding Position required to check if an applicant has appropriate Source of Funds and Use of Funds required to buy the asset. Funding Position is applicable for Asset Type Product group such as Secured Loan, Housing loan, Mortgage Loan etc. System Administrator can enable or disable Funding position screen as per bank requirement and it is configurable at product level. By default, Funding Position is enabled for all Mortgage and Remortgage Loan products.

Funding Position is shown only for the main applicant(primary borrower) and not for co-applicant(s) or (co-borrowers).

UX Overview

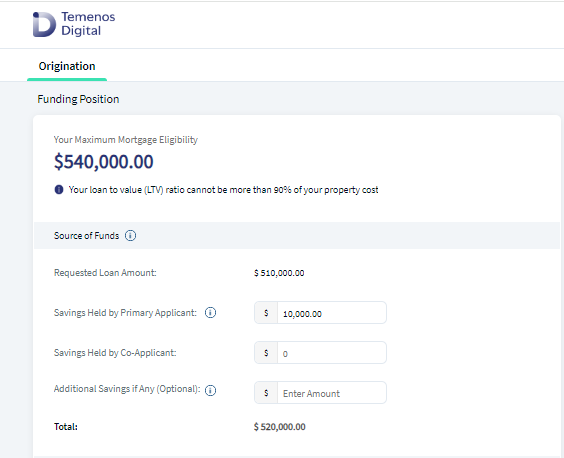

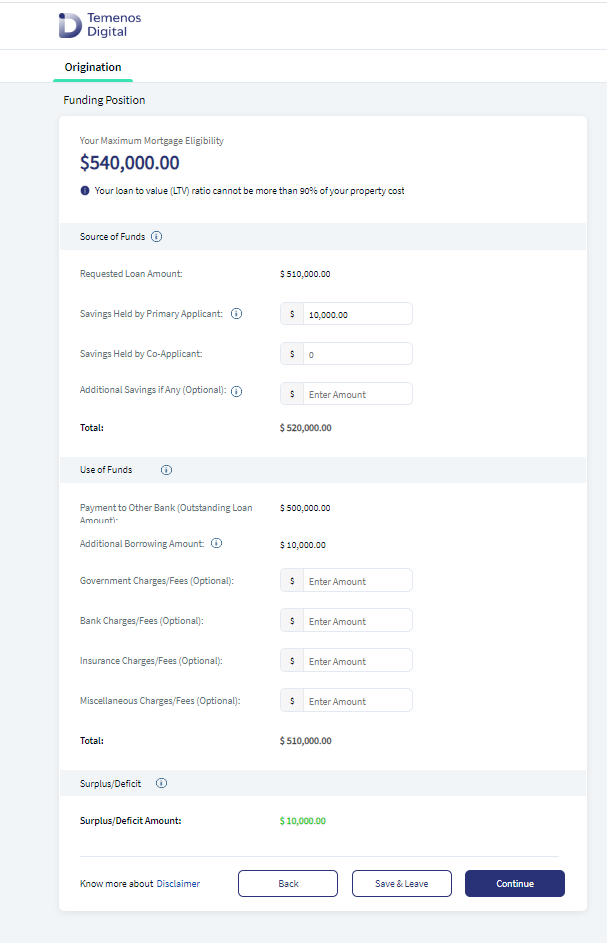

This section provides an overview of the Funding Position screen for Remortgage loan. Applicant's maximum mortgage eligible loan amount is displayed at the top of the screen based on the inputs provided by the Primary applicant & Co-applicant (if any) in the previous screens.

- Date of Birth: Personal Information screen.

- Net Monthly Income: Financial Information screen.

- Net Monthly Debt: Financial Information screen.

- Current Property Value: Property Details screen.

Funding Position section contains the following sub-sections:

- Source of Funds

- Use of Funds

- Surplus/Defecit Amount

If the applicant is an existing customer, only then other details such as Personal Information, Address, Income and Employment will be pre-filled.

- Source of Funds:

Source of funds section in the Origination App lists out how an applicant can arrange funds required to buy the property. If the Requested Loan Amount is same as Outstanding Loan Amount (Without Additional Loan), Source of Funds section displays the following fields:

- Requested Loan Amount : Requested Loan Amount is Same as Outstanding Loan Amount as applicant has not requested any Additional Loan amount in the Remortgage screen. This value pre-populates from the Remortgage screen. If the Requested Loan Amount is more than the Maximum Eligible Loan amount, an error message displays on the screen as Requested loan amount cannot be more than maximum eligible amount. Continue button is disabled and the applicant cannot proceed further. Click Back button to navigate to the previous screens to make the required changes.

- Savings held by Primary Applicant: Enter the Savings held by the Primary Applicant. This field is Mandatory field and defaults with 0.

- Contribution from Co-Applicant : Enter Contribution from Co-Applicant(s). This field is Mandatory field and defaults with 0.

- Other Source : Other sources includes Family, Friends, Relatives etc. This field is optional.

- Additional Savings if Any: Enter the amount of additional savings if any.

- Total: The field is the cumulative of the sum of all the values entered in all fields in Source of funds

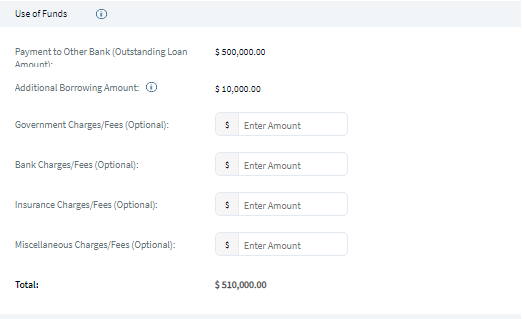

- Use of Funds:

This section displays the breakup of how applicant plans to spend the Loan amount to meet the various expenses required to buy the property. Additional expenses includes fees and other costs required to buy the property such as registration or notary fees. It has the following fields:

- Payment to other Bank(Outstanding Loan Amount) : This field is applicable only for Remortgage Loan. This value is not-editable and it pre-populates from Total Outstanding Loan Amount field in the Remortgage details screen.

- Government Charges/Fees: Enter Government charges if applicable. This field is optional.

- Bank Charges/Fees: Enter bank charges if applicable. This field is optional.

- Insurance Charges/Fees: Enter Insurance Charges if applicable. This field is optional.

- Miscellaneous Charges/Fees : Enter Miscellaneous charges if applicable. This field is optional.

- Total : The field is the cumulative of the sum of all the values entered in all fields in Use of funds.

If the Requested Loan Amount is more than Outstanding Loan Amount (With Additional Loan), Source of Funds section displays the following fields:

- Requested Loan Amount: Requested Loan Amount is Same as Outstanding Loan Amount as no additional Loan amount requested by customer in Remortgage screen. This value pre-populates from the Remortgage screen. If the Requested Loan Amount is more than the Maximum Eligible Loan amount, an error message displays on the screen as Requested loan amount cannot be more than maximum eligible amount. Continue button is disabled and the applicant cannot proceed further. Click Back button to navigate to the previous screens to make the required changes.

- Savings held by Primary Applicant : Enter the Savings held by the Primary Applicant. This field is Mandatory field and defaults with 0.

- Contribution from Co-Applicant : Enter Contribution from Co-Applicant(s). This field is Mandatory field and defaults with 0.

- Other Sources: Other sources include (Family, Friends, Relatives etc).

- Total Source of Funds: The field is the cumulative of the sum of all the values entered in all fields in Source of Funds.

Use of Funds: This section displays the breakup of how applicant plans to spend the Loan amount to meet the various expenses required to buy the property. Additional expenses includes fees and other costs required to buy the property such as registration or notary fees. It has the following fields:

- Payment to other Bank(Outstanding Loan Amount): This field is applicable only for Remortgage Loan. This value is not-editable and it pre-populates from Total Outstanding Loan Amount field in the Remortgage details screen.

- Additional Borrowing Amount : This field displays only for Remortgage Loans when the applicant opts for Additional Loan Amount requested as Yes in Remortgage details screen. This field is not-editable and the value pre-populates from Additional Loan Amount field in Remortgage details screen. Help icon is located beside the Additional Borrowing Amount, which displays the Help Text on how to use your additional Loan amount funds like for payments towards Renovation, Home Extension, Furnishing, Payment towards Debt Consolidation, Personal Expenses, etc.

- Government Charges/Fees : Enter Government charges if applicable. This field is optional.

- Bank Charges/Fees: Enter bank charges if applicable. This field is optional.

- Insurance Charges/Fees : Enter Insurance Charges if applicable. This field is optional.

- Miscellaneous Charges/Fees : Enter Miscellaneous charges if applicable. This field is optional.

- Total Use of Funds : The field is not-editable and it is the sum of all the values entered in all fields in Use of funds.

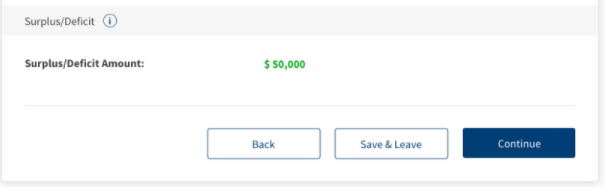

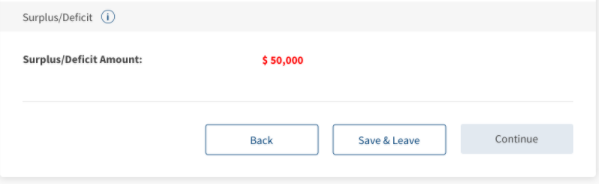

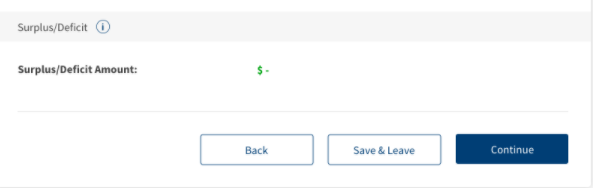

- Surplus/Deficit Amount:

This section calculates the difference between Total Source of Funds and Total Use of Funds which is not editable. Surplus/deficit amount contains a help icon. Click the icon to know more about the section.

- If the Source of Funds is greater than Use of Funds, it is indicated in Green. Click Continue to navigate to the next section.

- If the Source of Funds is less than Use of Funds, it is indicated in Red and Continue button is disabled. Applicant cannot proceed to the next section without providing the means to bridge the deficit amount.

- If the Source of Funds equals the Use of Funds, it is indicated as – which allows applicant to proceed to the next section.

Click Continue button, the control navigates to Mortgage Composition screen.

All the Funding Position related data updated through the Origination App is stored in the ODMS.

Experience APIs

The following APIs are shipped as part of this feature:

| API | Description |

|---|---|

| getDetails | This API retrieves the Funding Position details stored in ODMS. |

| updateDetails | This API updates Funding Position and stores in ODMS. |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Funding Position section, click here.

Extensibility

By using the Extensibility feature, the applicant can customize the modules based on the requirements. For more information, refer to Extensibility.

In this topic