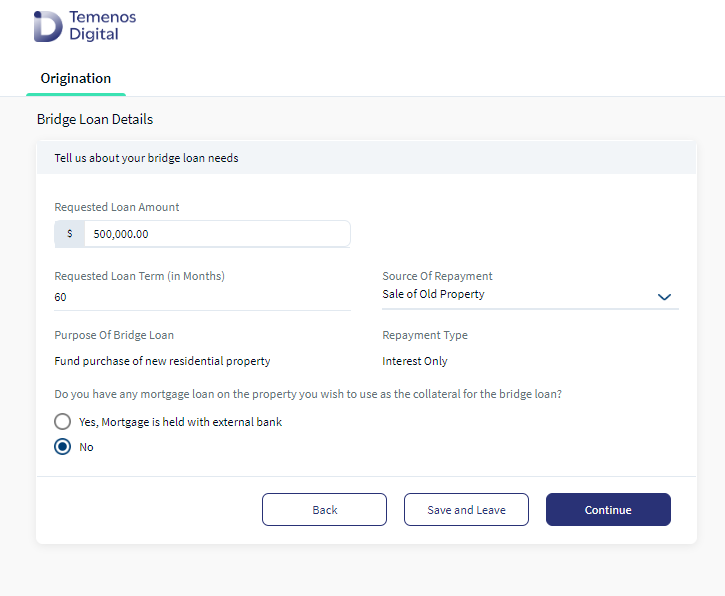

Bridge Loan Details

Bridge Loan details screen displays only when an applicant selects Bridge Loan in the Product Group dashboard Landing Page. Bridge Loan is a short-term loan used until a person or company secures permanent financing or pays an existing obligation. It allows the borrower to meet the current obligations by providing immediate cash flow. Bridge Loans have relatively high Interest rates and are usually backed by some form of collateral, such as real estate or the inventory of a business.

Bridge Loan Details displays only for the main applicant and not for co-applicant.

UX Overview

This section provides an overview of the Bridge Loan details screen. It captures information such as Requested Loan Amount, Requested Loan Term, Source of Repayment, Purpose of Bridge Loan, Mortgage loan on the property you wish to use as the collateral for the Bridge Loan, Outstanding Loan Amount and Repayment Type details.

Enter the following mandatory information in the Bridge Loan details screen. Bank user has the capability to configure the drop-down values such as .

- Requested Loan Amount : Enter the Requested Loan Amount in numerics.

- Requested Loan Term (In Months): Enter the Requested Loan Term( In Months) in numerics. Minimum value is 1 month and Maximum value is 12 months which can be configurable in Spotlight.

- Purpose of Bridge Loan: This is a drop-down field with values Fund purchase of new residential property, Renovation of new residential property, Renovation of existing property and Others. This field value pre-populates based on what the applicant selects in the product details screen and is a non-editable field.

- Source of Repayment: This is a drop-down field with available values as Sale of Old Property, Sale of Other Asset, Maturity of Term Deposit.

- Repayment Type: This field displays Repayment Type as Interest Only, and it is a non-editable field.

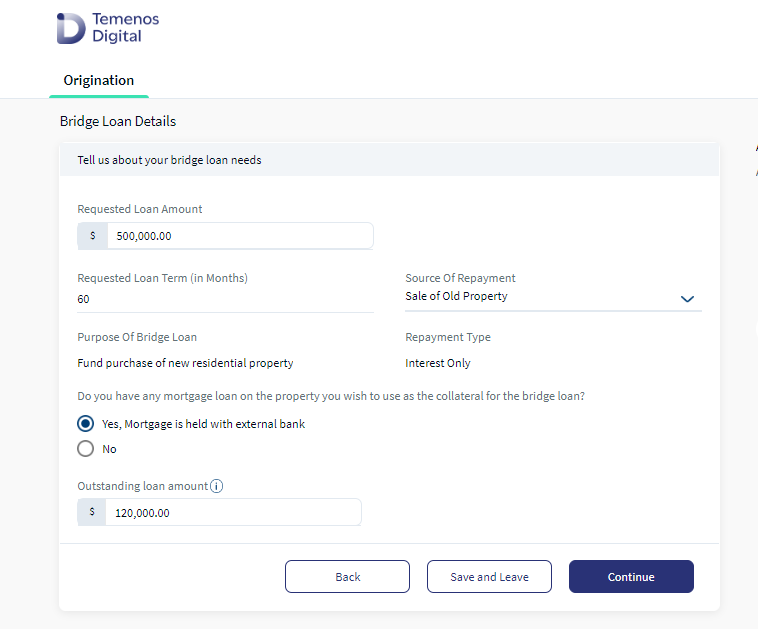

- Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?: Select the option from the available radio button as:

- Yes, Mortgage is held with this bank: If the applicant selects this option, enter the Outstanding Loan Amount in numerics.

- Yes, Mortgage is held with external bank: If applicant selects this option, enter the Outstanding Loan Amount in numerics.

- No: If the applicant selects this option, Outstanding Loan Amount field does not display on the screen.

- Outstanding Loan Amount: Enter the Outstanding Loan Amount in numerics. There is a Help icon next to the Outstanding Loan Amount Field. The text for the Help Icon is as follows. Ensure you upload your Existing Mortgage Loan Account statement from your internal/external bank in the Document Checklist screen which will be shown before you submit this Application. This statement should detail all your Loan Repayments made so far and current total Outstanding Amount against this Loan.

Continue button is enabled only after all the mandatory information is filled. Click Continue button and the control navigates to the Property Details screen.

To modify information in any of the previous screens, click the Back button to edit or modify the information as required in the Mortgage details screen. The modified values updates and reflects in all the subsequent screens.

To resume the application later, click Save & Leave. All the information entered in the application will be saved. Click Yes on the Save & Leave confirmation pop-up. For prospect customer, you will receive the following email with an application resume link, user name, and application number. A temporary password is sent to the registered phone number.

In this topic